Russia is losing revenue from oil sales, according to KSE.

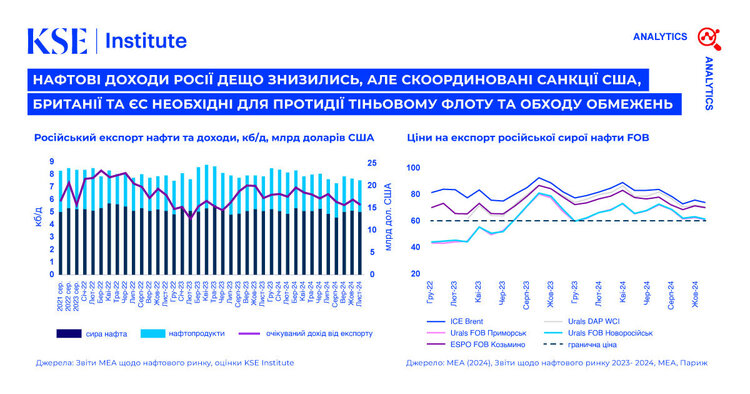

In November 2024, Russia's oil export revenues decreased by $1.1 billion to $14.6 billion. This decline was attributed to lower oil prices and export volumes.

This is mentioned in a study by the KSE Institute.

According to the institute, in November, Urals crude oil FOB Primorsk became cheaper by $1.4 (costing approximately $61.1 per barrel), while Urals FOB Novorossiysk dropped by $1.1 (costing $61.9 per barrel).

“The discount to ICE Brent narrowed to about $12 per barrel. All premium oil products traded below the price cap, while discounted oil products, despite the price decline, continued to be sold significantly above the price limit,” the study states.

It is noted that in the same month, Russian crude oil exports by sea decreased by 4.2%, while the export of oil products increased by 0.9%.

“Only 10% of crude oil and 62% of oil products were transported by tankers with IG P&I insurance. The coverage level varied by port: 45% of supplies from the Baltic Sea and 34% from the Black Sea utilized insurance… Meanwhile, all exports from the Pacific and Arctic ports relied entirely on the shadow fleet, bypassing Western maritime services,” the study reveals.

According to the KSE Institute, the majority of Russian oil exports continue to be carried out using old and inadequately insured vessels from the shadow fleet, posing significant environmental risks.

It is clarified that in November, 196 shadow tankers loaded with crude oil and oil products departed from Russian ports, 85% of which were over 15 years old.

It is mentioned that these tankers account for 90% of crude oil exports and 36% of oil product shipments, allowing Russia to circumvent the price cap of $60 per barrel and finance its war in Ukraine.

It is emphasized that as of December 19, 2024, the USA, EU, and UK imposed sanctions on 156 tankers transporting Russian oil. However, key vessels of the Russian shadow fleet largely remain outside of sanctions, the study noted.

“Only 7 out of 20 tankers, which are the largest carriers of Russian oil, have been sanctioned... To evade restrictions, Russia regularly changes the managers of the vessels. Since January 2023, 13 of these tankers have changed managers while retaining their country of registration,” the material states.

It is clarified that this complicates the tracking of vessels and delays the sanctioning process. Additionally, vessel managers from the UAE and China continue to facilitate the transportation of Russian crude oil above the price cap.

“In November, Avebury Shipmanagement LLC-FZ (UAE) became the largest carrier, accounting for 11% of Russian crude oil exports by sea. Five Chinese companies accounted for another 11% of the exports,” the study states.

At the same time, Greek companies lead in the transportation of oil products, controlling approximately 25% of shipments. India, China, and Turkey remain key buyers of Russian crude oil, with India alone accounting for 47% of total imports.

According to KSE Institute calculations, Russian revenues from oil sales under the current price caps and sanctions status quo are projected to reach $141 billion in 2025 and $135 billion in 2026.

Background. Earlier, Mind reported that oil prices are rising due to supply cuts from Russia and OPEC countries. The price of Brent crude increased by 28 cents (0.36%), reaching $77.33 per barrel. The price of American West Texas Intermediate rose by 40 cents (0.54%), reaching $74.65 per barrel.